If you haven’t done so already, it’s time to update your files for the New Year.

I thought I’d share how I organize my finances electronically to avoid finding more space for paper files.

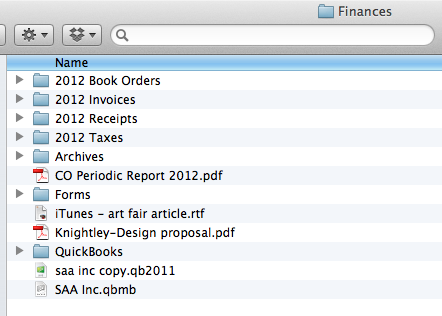

Here’s how my Finances e-file looked a couple of days ago.

Note that I have 4 major files for every year: Book Orders, Invoices, Receipts, and Taxes.

I add the year (2012 in this case) to the names of the files because they’re the same folders every year and I wouldn’t be able to tell them apart in a search if they weren’t differentiated somehow. (This took me a long time to figure out!)

When the New Year Begins

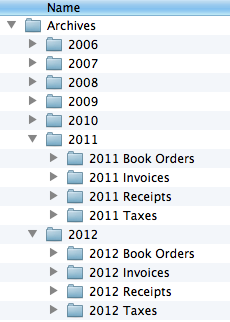

1. When the New Year begins, I put all of the old files into the Archives.

The image at right shows where those 2012 folders are now. →

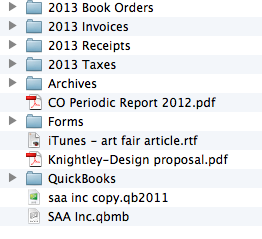

2. Then I create new folders for the New Year – using the same old categories. ↓

By using consistent folder names, I create a habit. I know what things are called when I go to look for them!

I Haven’t Given Up on Paper

E-filing is my preference for a simplified workflow, but paper receipts are inevitable. Because I believe in making things easy, turning all paper receipts into e-documents is an unnecessary extra step for me.

I file all of my paper receipts and invoices for my business in an accordion folder by month.

This system has worked for me for years. (Update 2023: Still working for me!)

Steal from it what you think might work for your business or tell us your alternative method in a comment below.

16 thoughts on “Organizing Financial Invoices and Receipts Electronically”

I briefly considered Neat Receipts when I did a ton of traveling with a ton of receipts, but the drawback, if I remember correctly, was the versions not working with each other.

Anyone tried this scanner ?

Considering tax season is coming up it’s definitely time to organize our files. This year I need to do better with saving receipts for materials and art supplies. This is an income-tax deduction.

I use Quicken for Home and Business. It has more features than I need, but it’s working for me. It’s easy to have totals every year for taxes. As for paper receipts, I file them in a folder for the year. When taxes are done, that folder goes into storage with all the tax info and forms.

This is a great post, Alyson! Creativity comes easily to most artists, but this kind of practical suggestion for efficiency is so helpful. I love your blog. I always learn something useful.

Thank you, Mary Lou. I am glad you’re here.

This is VERY helpful, Alyson! Organization is something I know I need to get better at — and that includes organization of financial records, both paper and electronic. As my activities have expanded and diversified in recent years, my sense of myself as an organized person has gone out the window. Step by step, I’m pulling things together and aiming toward putting them in containers. This post is a big help! Thanks.

Leslie: I’m glad it’s helpful. One trick I’ve learned about staying organized is to follow a task through to completion. No multitasking! I don’t always follow this advice, but when I do, it works.

Thanks for the reminder – I’m terribly inefficient when it comes to being organized financially/administratively regarding my own business. I’m going to take that on as a new resolution. Here’s a thought – what about taking a quick photo of a newly collected receipt if you want to stay digital? Knowing my anal self like I do – I’d probably want to back it up with the paper copies :-/

Lisa: You can absolutely do that! But it would still mean extra steps for me. Take the picture, get it on the computer, file it. I’m trying to avoid that extra work.

This is another reason I like you, Alyson. Your shared thoughts & ideas are so on target for the community of creative artists. We appreciate practical ways to move our business in positive directions. Thank you for being so genuine!

Aw, thank you, Paula. That means a lot to me!

Love your method….Tho’t I’d share mine. I set up three files for each year: Art income, Art expenses, Taxes. I also have created an Excel spreadsheet that lists everything there…new tabs for each year. The template can be cut and pasted for each new year: Income: sales, including title of painting, size, buyer, retail, gross, net, commission, etc. Other income includes art instruction, awards, sales of note cards, etc. Next section is expenses including supplies, taxes, shows, education, travel, marketing, etc. I have found that keeping this up as I go is MUCH easier and is a good way to see how the year is progressing. I check off the receipt as it’s entered into the spreadsheet and drop it into the file. Excel makes it easy to create sub and grand totals. I also have my ATM make a copy of deposited check images and drop them into my income file.

Karen: Sounds like a good system that works for you. However, I would suggest switching to Quickbooks as you grow.

Alyson,

I am in the middle of an audit right now and had put into place a system of organization last year after your class on collectors. It helped with my husbands handyman business too. Let me tell you, the irs wants copies of everything. I am glad I had the neatdesk to scan my paper into last year. Searching through the computer is easier than a pile of papers ever was. Now I want o learn QuickBooks online and keep things off site. Thanks for always giving valuable info. I love this end of the year computer archiving too. Will try something like that for me too.

For the past several years, I’ve just kept all receipts in a little accordion file; pull them out at tax time, and add it all up. My art expenses and income was fairly minimal, but I pretty much always had a loss. I’m starting to worry that I may be audited, simply for that fact. WIll my simple stack of papers in an envelope for each year be enough? I do intend to start translating my info to digital over the course of this year (using Bento – not really financial software), but it all seems like so much more work to me:(

I can see that some of you have very simple systems and some way more than I could handle. I use Quicken and monthly file folders – a set for personal and one for business. Then I have a few folders for separate items like health receipts, utilities, communication, tax items and credit cards. The best thing that I have been doing is paying for most everything with a few credit cards. I pay these off in full each month, but the credit card bills keep a very neat and easy to find record for me.