Artist Geri Dunn was stunned when someone purchased a gift certificate of hers at a silent auction and then wanted to either 1) redeem it for cash or 2) commission an original drawing for the amount on the certificate ($150). People really do ask/demand the darndest things!

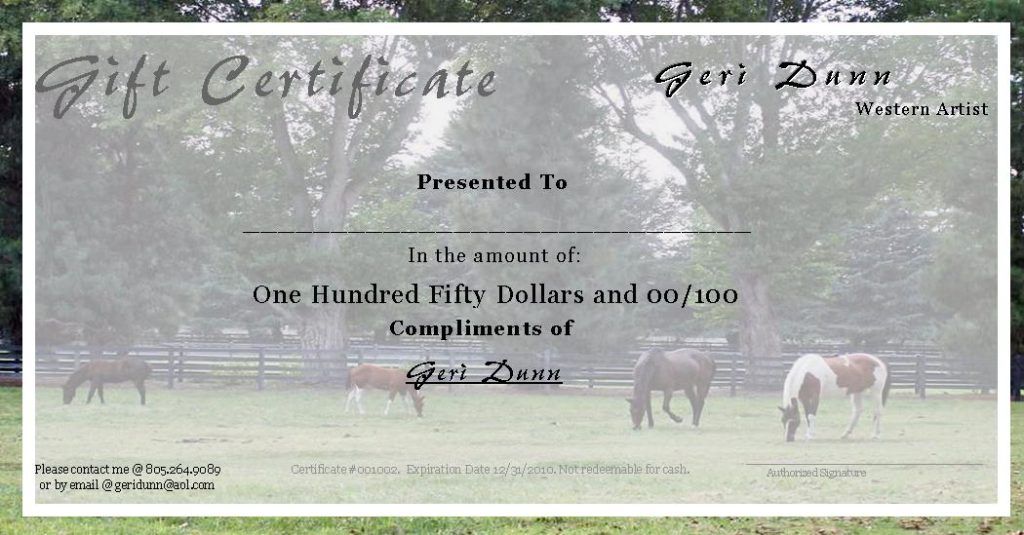

Let’s look at the situation and start with the gift certificate itself, pictured here.

The small lettering on the bottom row consists of these three components.

- The artist’s contact information–phone and email.

- The certificate number, expiration date (12/31/2010), and the words “Not redeemable for cash.” Having an expiration date is important! And the “not redeemable” phrase proved key when the recipient tried to cash it in. Geri was able to point to this language and quickly put an end to that discussion. The words “No Cash Value” could also be used or added.

- A place for the authorized signature (presumably the artist’s or the organization that auctioned it off).

Without knowing the context of how this was promoted in the sale (Was there any text that went along with it or in a catalog?), I see one crucial piece of information missing on the gift certificate–>What can it be used for?

A simple phrase like “To be used toward the purchase of original art or prints by Geri Dunn” might have covered it.*

You could also add the phrase “Non-Transferable” if you want to ensure that only the purchaser is able to use the certificate.

Go over details with the organizers

It’s difficult to have control over your donations if you aren’t involved with the organization or in attendance, but there are some things you can do to have a smoother experience.

Whenever you donate a gift certificate, talk details with the organization. The nonprofits I’ve been involved with have had forms for donors to fill out. Write out the specific terms of your donation on the form and make sure you sign it somewhere. If the organization you’re supporting doesn’t have a form, make up an official letter of your own. Address your donation letter to the organization and include it when you deliver the gift certificate.

If you really want to go all out, see that anything in print (a catalog, brochure, or label) is more specific than “Gift Certificate.” Perhaps “Gift certificate toward the purchase of art by Geri Dunn” would be sufficient. I know this might sound like going overboard, but I’m amazed at how few people read the details of an offer. The more bases you cover, the fewer headaches you’ll have in the long run.

If necessary, provide a separate “Terms of Use” document to go along with the certificate or, better yet, print the terms on the reverse of the certificate itself.

You can also use and adapt many of the above tips for certificates that are purchased from you and given as gifts.

*Disclaimer: I’m not an attorney. I’m sure that state laws differ on such matters, so please do some research before you create your gift certificates.

17 thoughts on “What to Put on a Gift Certificate for Your Art”

Wow, someone trying to redeem a gift certificate for cash never occurred to me. Thanks so much for this, I’ll be linking.

This brings up an interesting idea. Generally, I don’t like to donate works of art because you cannot claim the true value of the piece. I will check with my tax person to see if donated gift certificates for a specific value towards an art piece can be used as a write off. Thanks!

State laws do seem to differ on these things. In California a gift certificate cannot have an expiration date. The Consumer’s Union website has a list of the states and what’s allowed: http://www.consumersunion.org/pub/core_financial_services/003889.html.

Here’s an updated link for gift cards: http://www.consumer.ftc.gov/articles/0182-gift-cards – from the FTC.

Alyson,

I’m not sure, but I’m going to ask my tax advisor when we do taxes in a few months.

It just seems, though, that since a donation of art can only be written off for the costs to make the art, maybe a gift certificate towards the purchase of art can be counted as cash when it’s cashed in? I hope so! It would definately make donating a little more palatable.

I will report back my findings – either way.

Thanks for all your great posts,

Mira

Mira: That is an interesting point. At what point in a gift certificate transaction do the tax laws apply?

Katherine: Thanks for this link! You’d think you’d want an expiration date, but it doesn’t matter so much if it’s going to be applied toward something else. Your prices may go up, but the value of the certificate remains the same.

Thanks for your help on this Alyson! I’m definitely going to incorporate a lot more wording on my next gift certificate. As always, I love your blog, they always bring new thoughts to the artist. Keep up the great work!!!

Connecticut, where I am located, is also one of those states that does not allow for the expiration dates of gift certificates. I wonder if there are other legal limitations one needs to be aware of when issuing gift certificates. I suppose the best thing would be to contact one’s home state.

Sigh, I hit the post button too soon. The Consumers Union site gives a lot of the state limitations but I suspect these may not be the entirety as I see some of them are quite complex (CT is easy – no expiration, no fees). I have to admit, though, I would not have expected anyone to ask for cash from a gift certificate!

Alyson, thanks for this discussion. I didn’t realize there were so many things to consider.

The gift certifcates I have sold have been for lessons, where no dollar value is specified. Since I expect my prices to rise, I realized the importance of an expiration date. The certificates sold early in the year expire at the end of the current year, unless prior arrangements are made. Later ones expire the end of the next year.

I also include:

“This certificate may be exchanged for group lessons or art. It may not be redeemed for cash.”

Katherine, Thanks for the link to the legal expiration requirements. Looks like I’m legal on that score for the states I’ve sold in.

Ann

I wonder what the difference is between laws affecting gift cards and those for gift certificates–if any. ??

Geri: Thanks for the great question and case study.

Ann: Looks like you’re armed with knowledge and ready to face the world.

Alyson, apparently, yes, for some places certain rules for cards don’t apply to paper certificates. I don’t know if that’s because of the nature of the medium or for some other reason.

See, I would have just assumed it could only be used for original work or prints that were offered. Thanks for that link about state gift card laws. I was considering making some of these myself, so it helps to have some backup info.

I have donated for years and have used the gift certificate idea . So far I haven’t had but one problem. One woman has gotten my $100 gift certificates at 3 different auctions. I wanted to use the certificates to advertise my work and attract new clients. Thanks for all the advice on expiration dates because she has gotten them in 09 and 2010 and now I have to honor them. This will help solve the problem in the future. An idea that other artists may be interested in was how I presented my work. Not only did I have post cards with resume and contact info I had a CD in a laptop(an old computer) showing my work.I asked that my donation be placed near an electrical outlet. I think a lot more people looked at it than at some of the donations with a few cards or written material.

Pat Regan, I love your exhibit idea!

As for the woman who bid and received your gift certificates, try thinking about it as she is rewarding herself (perhaps by getting a gift for someone that she mightn’t otherwise) for generously bidding on something charitable. 🙂

Excellent advice! People definitely don’t read, but it’s important to be very specific – better to be safe than sorry.

I rarely donate gift certificates. If I do, it’s for existing works/merchandise only, not a commission. I have no control over a commission purchased via GC. I want to talk to someone before I accept a commission and have the option to decline if the client’s vision and mine don’t match.

Although I can see that this commentary has been around almost 2 years, it still has some good info. I just wanted to add some ‘bookkeeping’ info to the mix: when you offer gift certificates where a customer has purchased one as a gift, the sale is a liability on your books until the service is rendered and product sold. IE: they purchased a session and an album using the gift certificate as part of the payment at the time the service was rendered. If you live in a state where these certificates have no expiration (by law), then you should always have the money in your account to back up the cert in the event you need to refund it. However… do your certificates state “Non-Refundable” ? Either way, it is my understanding that the money you received for a gift certificate is recorded as a liability on your books. Once the service is rendered and the certificate tendered, you move the money from a liability account to your income (Gross Sales) account. It will / should now be gross income on your books. If it sits for a year on your books as a liability, (meaning you could owe it back out at some point to the customer who purchased it), check with your tax accountant. A portion of it might be taxable.

When you donate a certificate to a charity event, I would think 1) it has no cash value; 2) non-refundable; 3) redeemable only for session or product or both; 4) should not have an expiration since there is no real money involved. As another person commented earlier, donation may be tax deductible but she wondered ‘when.’ Again, I would think once it has actually been used / tendered toward a service or product.

Please double-check with your tax adviser as the laws continually change. I would also suggest that you keep tight record on gift certificates sold / donated, when they were sold / donated and then tendered, and pass these details to your tax accountant at year end.