Most artists don’t want to think about what might go wrong in their businesses. It’s not sexy to talk about backing up, getting insurance, or mitigating risk.

Art Biz Blog readers (you!) know that these unsexy topics are necessary to confront.

Do not put this off. Right about now you’re probably saying Bor-ing! and you want to leave. But this is critical.

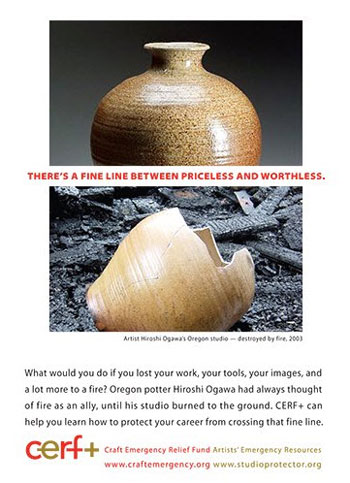

Take a look at any of the stories on the Craft Emergency Relief Fund (CERF+) website and you’ll see that many artists haven’t acted in time.

Whether it’s the floods in the Midwest, the hurricanes on the East Coast, the fires in the West, or a freak accident, your livelihood is at risk.

You cannot control disasters. You are a victim to their fury.

You might as well work on the things you can control and mitigate the effects of a natural or manmade disaster. These tips were generated with the help of CERF+.

1. Understand your business insurance coverage.

Homeowner’s and renter’s insurance almost never covers business-related losses or liability. Your art business most assuredly falls under the category of business insurance.

Read your policy! Know where you stand and seek supplemental business insurance if you’re not covered.

2. Save!

You need a cushion of savings to get through any disaster. This comes in handy even when the disaster is a prolonged illness.

Put aside money in a savings account to help you survive a rough period.

3. Consider flood insurance.

What is your risk of flooding? Serious flooding can result not just in coastal areas but far inland in low-lying areas and near rivers and streams.

We are currently witnessing the devastation from spring rains and snow thaws and hurricane season begins a month from now.

Be aware that serious flooding sometimes occurs in areas that are not designated as flood zones.

While insurance normally covers water damage from burst pipes or leaking roofs, neither business insurance nor homeowner’s insurance covers damage from “rising water.”

The National Flood Insurance Program sells insurance to cover these risks. You need separate flood insurance policies to cover your home and your business assets, even if your art-related business operates from your home. Renters can also buy this insurance.

4. Back up your computer and store a backup copy in a safe place.

You’ve heard this before, but are you doing it? No one really believes it’s necessary to back up off-site until it’s too late.

A safe offsite location can store copies of your images and critical records such as business documents, sketches, glaze formulas, and process notes. This place should be 50-100 miles away from your studio, where it is unlikely to be affected by the same disaster.

A safe deposit box in your community, while useful, may not be the best place to put this material.

A safe deposit box in your community, while useful, may not be the best place to put this material.

A good option these days might be online storage, like Dropbox. I use Backblaze to back up my computer to the Cloud.

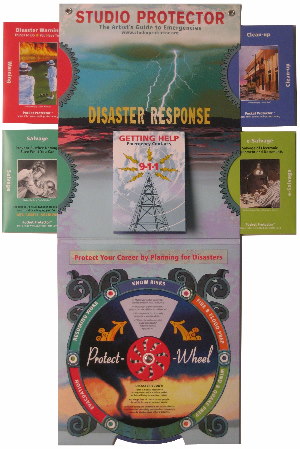

5. Get the Studio Protector.

CERF+ has created the Studio Protector, a terrific and inexpensive tool to help you prepare for an emergency. (One side is shown here.) At only $16, the Studio Protector will help you be savvier about your assets.

Today is MayDay, designated by the Society of American Archivists as a time to encourage those in the cultural communities to prepare for disaster in order to protect our heritage. Your art is part of that heritage.

Share your stories about disaster-related lessons you learned too late. Your experience may prompt another artist to take action this MayDay.

4 thoughts on “Is Your Art Business Prepared For Disaster?”

Another area of concern where artist’s should focus is on your biggest asset….you! Recently, I was diagnosed with breast cancer and thank goodness we had taken out some critical illness insurance. It’s helping us to get through surgery, chemo and radiation which is about a 9 month ordeal. Imagine what it would be like if you were unable to work at all during that time period. Talk to your insurance agent and see if you can ensure that you INSURE yourself! Without you….there is no art!

Brilliant, Janice. Thank you for sharing that! We are sending our warmest thoughts to you.

Thanks Alyson. Often, we forget about ourselves as the most important “tool” in the equation, and while our focus may centre on the business, and all of the elements that go around to marketing it, the fact is – we need to care for ourselves. That’s where all things originate.

Take some time to smell the roses…instead of painting them, so to speak. 😉

You’re always in my thoughts!

Thanks for the link about May Day: Saving Our Archives. It is a very important reminder to review procedures and plans about what to do during a disaster. I wanted to re-enforce #3 about flood insurance. It is very true – even if you live inland, above sea level, you can get what is called storm surge from hurricanes. Also, tornadoes spawn well inland during hurricanes. I grew up in hurricane country and I have to say, the storms have only become more severe and worse over time. I do not have any scientific proof of that, just as a human being and the “feeling” is they are getting worse.

In the case you have a warning such as a storm, priorities of course to keep yourself & family safe and evacuate, but I would add having a vehicle like a van is a good investment so you can pack some of your important things. All of the other advice in your post is good. After following all of that – on a personal note, backup and save your family photos. They are simply not replaceable and truly devastating to lose above all other material things.